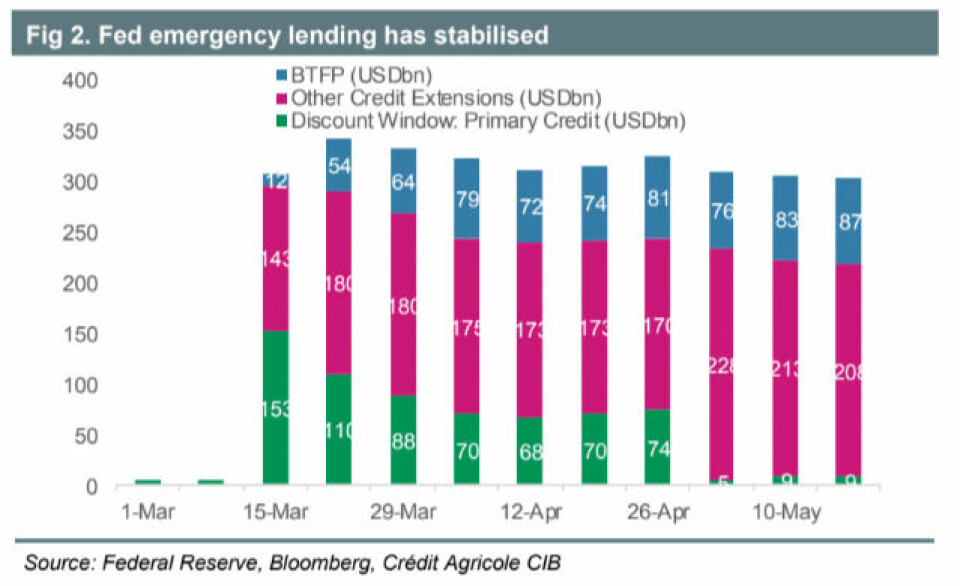

Feds kriselån har stabilisert seg

Credit Agricole har sett på Den amerikanske sentralbankens bruk av det såkalte discount window for å øke likviditeten til banker:

It became clear that First Republic was responsible for a good chunk of the discount window borrowing when, during the week ended 3 May, discount window borrowing dropped to only USD 5bn to bring the sum of discount window and BTFP borrowing to USD81bn, while other credit extensions jumped to USD228bn from USD170bn.

As of the week ended 17 May the combined total of discount window and BTFP borrowing sits at USD96bn, a bit above the 3 May level but substantially below the mid-March reading. This indicates thatwhile stress may not have completely disappeared, it has certainly calmed compared to the initial burst.